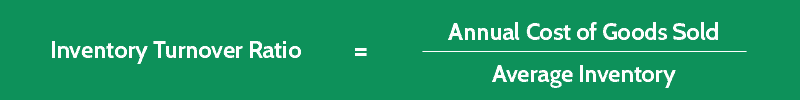

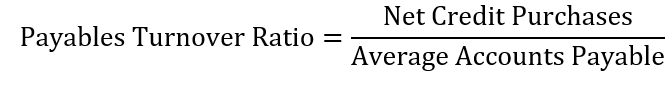

The net credit purchases can be calculated as follow: Advertisements The net credit purchases, as mentioned, can be replaced with the cost of goods sold for merchandising business if all goods purchased were on credit. It can be calculated as,Īverage Accounts Payable = (Beginning balance + Ending balance)/2 The average account payables are the average of the specified period. The following simple formula can calculate the payables turnover ratio,Īccount payable Turnover Ratio = Net Credit Purchases / Average Accounts Payable Formula For Calculating Account Payable Turnover Ratio AdvertisementsĪccounts payable turnover ratio is that method to assess the payback ability regardless of the company’s size, industry, and amount. Therefore, an unbiased and explicit method of assessing a company’s payback ability is required. įor all these reasons, the creditors need to know how good the company is as a debtor. But the amount might not be material compared to the company’s size. For instance, a creditor might believe that a company has higher accounts payable. Secondly, the concept of materiality is very critical in assessing different companies or industries. Similarly, the lower account payables aren’t always good. The higher accounts payable might be due to a reasonable payment policy and quick payback periods of the entity. Firstly, the higher account payables of a company might suggest that they are in a big problem. When the balance sheet of a business entity clearly states the accounts payable balance, why calculate the account payable turnover ratio?Īny outsider, investor or creditor, cannot make a rational decision by just looking at a company’s cash, sales, or even account payables. Why Calculate Account Payable Turnover Ratio?Ī question might arise as to why a business entity needs to calculate its account payable turnover ratio. The account payable turnover ratio shows a business entity’s cash management practices. Related article Accounts Receivable Turnover Ratio Analysis: Overview, Formula, And Analysisįor instance, the company’s account payable turnover ratio can be found yearly, bi-annually, monthly, etc. More appropriately, the account payable turnover ratio is the average number of times a business entity honors its account payables balance during a specific period. It is a liquidity ratio that measures how fast a business entity pays to the suppliers and creditors for extended lines of credit. The account payable turnover ratio can be described as, These ratios give useful insights to the creditors and investors of the company to issue debt or make an investment. The liquidity ratios generally measure a business entity’s ability to meet its debt obligations(short term). The account payable turnover ratio is a liquidity ratio. This article is all about the account payable turnover ratio and how does it help stakeholders. Therefore, financial ratios help assess a business compared to other companies working in the same industry. It is uncertain whether a company is good or bad merely looking at account payables or account receivables. However, the comparison of different companies by different stakeholders is also critical. Accounts payable corresponds to the services taken or purchased products yet to be paid for.Īlthough, the accrual accounting method solved the true-reflection problem.

AdvertisementsĪccounts payable and accounts receivables are the most common factor in accrual-based accounting. Regardless of when cash is received or paid, the business entity’s income statement and balance sheet reflect the truest view of financial health and position.

Under accrual accounting, all the transactions, cash or credit, are recorded in the books of accounts.

It is built on basic accounting principles to ensure true and fair representation of financial position. The accrual accounting method is the most commonly used with the basic characteristic of a true reflection of a business entity’s income or loss. However, the accrual accounting method was introduced to make business transactions and bookkeeping convenient. Simultaneously, the cash basis results are less accurate and do not reflect actual income or expenses. On the one hand, the bookkeepers have to maintain different books for recording transactions. It adds a lot of inconvenience to the bookkeeping and financial analysis. What is meant to say, if a sale occurs, it will not be registered as a sale in the accounts until the buyer pays the cash. Either expenses or income was recorded once the cash was involved in the transaction. In primitive accounting methods, the cash basis of accounting was a general practice.

0 kommentar(er)

0 kommentar(er)